COT Report - Read it online here

Here are this week’s links to the latest Commitment of Traders data changes that were released on Friday.

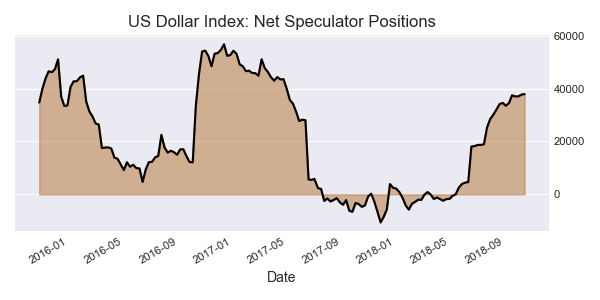

- Currency Speculators added to US Dollar Index bullish bets. Euro, NZD bets fall further

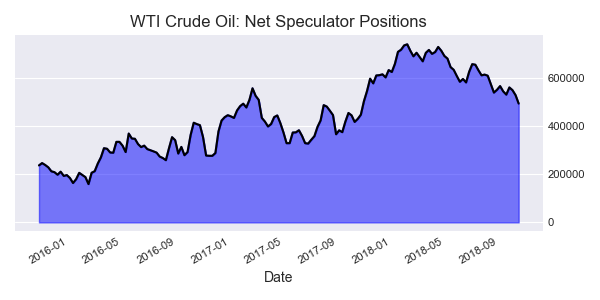

- WTI Crude Oil Speculators continued to reduce their bullish bets

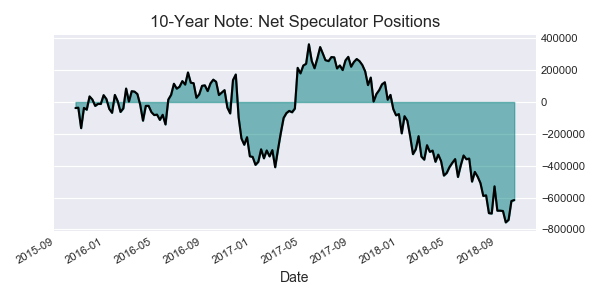

- 10-Year Note Speculators bearish bets declined for a 3rd week

- Bitcoin Speculators edged their bearish net positions lower

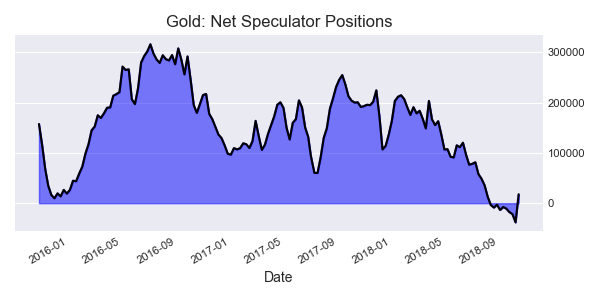

- Gold Speculators sharply boosted their bets into a new bullish position

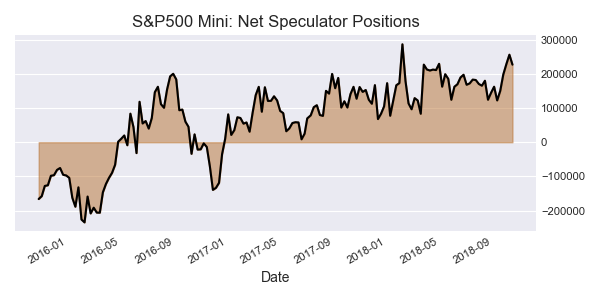

- S&P500 Mini Speculators reduced bullish bets for 1st time in 5 weeks

- VIX Speculators sharply dropped their bearish net positions

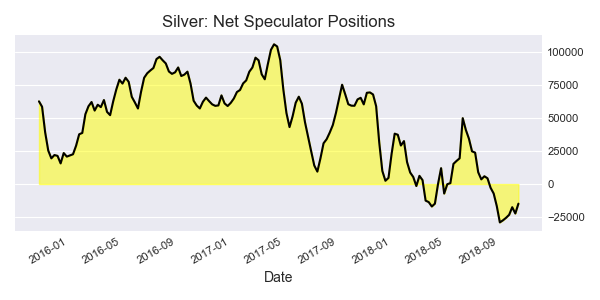

- Silver Speculators cut back on their bearish bets again

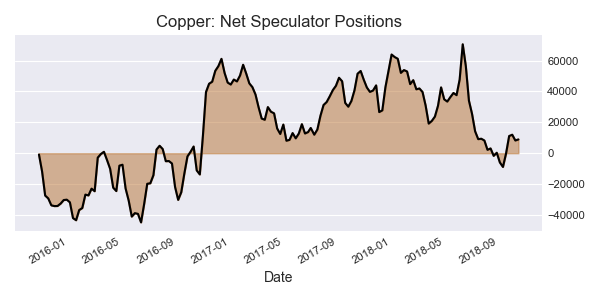

- Copper Speculators edged their bullish net positions higher this week

Currency Speculators added to US Dollar Index bullish bets. Euro, NZD bets fall further

US Dollar Index speculator positions edged higher for 3rd week

The latest data for the weekly Commitment of Traders (COT) report, released by the Commodity Futures Trading Commission (CFTC) on Friday, showed that large traders and speculators continued to increase their bullish bets for the US Dollar Index while sharply betting against the European common currency again this week. See full article

WTI Crude Oil Speculators continued to reduce their bullish bets

The non-commercial contracts of WTI crude futures totaled a net position of 493,229 contracts, according to data from this week. This was a slide of -34,822 contracts from the previous weekly total. See full article

The non-commercial contracts of WTI crude futures totaled a net position of 493,229 contracts, according to data from this week. This was a slide of -34,822 contracts from the previous weekly total. See full article

Gold Speculators sharply boosted their bets into a new bullish position

The large speculator contracts of gold futures totaled a net position of 17,667 contracts. This was a weekly advance of 55,842 contracts from the previous week. See full article

The large speculator contracts of gold futures totaled a net position of 17,667 contracts. This was a weekly advance of 55,842 contracts from the previous week. See full article

10-Year Note Speculators bearish bets declined for a 3rd week

The large speculator contracts of 10-year treasury note futures totaled a net position of -615,970 contracts. This was a weekly increase of 6,452 contracts from the previous week. See full article

The large speculator contracts of 10-year treasury note futures totaled a net position of -615,970 contracts. This was a weekly increase of 6,452 contracts from the previous week. See full article

S&P500 Mini Speculators reduced bullish bets for 1st time in 5 weeks

The large speculator contracts of S&P500 Mini futures totaled a net position of 226,792 contracts. This was a decrease of -29,027 contracts from the reported data of the previous week. See full article

The large speculator contracts of S&P500 Mini futures totaled a net position of 226,792 contracts. This was a decrease of -29,027 contracts from the reported data of the previous week. See full article

Silver Speculators cut back on their bearish bets again this week

The non-commercial contracts of silver futures totaled a net position of -14,827 contracts, according to data from this week. This was a weekly gain of 7,423 contracts from the previous totals. See full article

The non-commercial contracts of silver futures totaled a net position of -14,827 contracts, according to data from this week. This was a weekly gain of 7,423 contracts from the previous totals. See full article

Copper Speculators edged their bullish net positions higher this week

The large speculator contracts of copper futures totaled a net position of 8,918 contracts. This was a weekly boost of 671 contracts from the data of the previous week. See full article

The large speculator contracts of copper futures totaled a net position of 8,918 contracts. This was a weekly boost of 671 contracts from the data of the previous week. See full article

Article by CountingPips.com

The Commitment of Traders report data is published in raw form every Friday by the Commodity Futures Trading Commission (CFTC) and shows the futures positions of market participants as of the previous Tuesday (data is reported 3 days behind).

To learn more about this data please visit the CFTC website at http://www.cftc.gov/MarketReports/CommitmentsofTraders/index.htm

Copyright © 2017 CountingPips.com, All rights reserved. Forex News & Analysis Services provided to our newsletter subscribers.

If you would like to unsubscribe to our email list please Unsubscribe here

Risk Disclosure: Foreign Currency trading and trading on margin carries a high level of risk and can result in loss of part or all of your investment. Due to the level of risk and market volatility, Foreign Currency trading may not be suitable for all investors and you should not invest money you cannot afford to lose. Before deciding to invest in the foreign currency exchange market you should carefully consider your investment objectives, level of experience, and risk appetite. You should be aware of all the risks associated with foreign currency exchange trading, and seek advice from an independent financial adviser should you have any doubts. All information and opinions on our website and expressed in our newsletter are for general informational purposes only, are only the opinions of the author and not necessarily the opinion of CountingPips. All opinion and information within absolutely does not constitute investment advice.

countingpips llc

0 comments:

Post a Comment